It takes time to sort and count money. It only makes sense for businesses that accept cash for transactions to make this process as quick and convenient as possible.

Banks and credit unions aren’t the only businesses that rely on counting machines and currency sorting to stay organized. Retail shops, service providers, churches, and government agencies use this technology to sort loose cash into stacks.

If you know that 50 $20 bills equal $1,000, it makes sense to stack the cash in that way to make future counting or distribution efforts easier to manage. Today’s best cash counters can detect counterfeit bills by using black lights to illuminate the fluorescent symbols printed on the paper.

Knowing how much money is in a stack ensures you have what you need when requesting or depositing funds.

How Much Money Is a Stack?

A money “stack” is a slang term for having $1,000 in US money. Although the most common option would be to use 100 $10 bills for this purpose, the figure of speech also applies to 1,000 $1 bills or ten one-hundred-dollar notes. The money is delivered to the recipient in that sequence, leading to the origination of this term.

Before debit cards and automatic teller machines (ATMs), people went to the bank when they needed money from their accounts.

Some people kept all their cash at home because they didn’t trust the financial institutions or wanted faster access to their currency.

When account holders would go into a bank, they’d request a specific amount as they do today. The $1,000 amount was considered “stacks of the ready,” indicating that the value was pre-counted in the facility for convenience.

It isn’t convenient to ask someone for “eight stacks of the ready” when requesting $8,000. We often shorten long terms to make them more suitable to say, so people began asking for the specific number of stacks needed for a withdrawal.

“I’ll take eight stacks, please.”

More recently, we’ve begun to speak of a “stack” as a denomination because inflation has devalued goods and services compared to the dollar. If you buy a TV with a retail price of $1,035, the retailer might ask for a “stack plus 35” to complete the transaction.

How to Withdraw Cash at Banks and Credit Unions

If you want to withdraw stacks from your checking or savings account, the easiest way to complete this request is to visit your local branch. Most institutions require you to fill out a withdrawal slip to authorize the transaction.

Most people have a checking and a savings account associated with their membership or status at their financial institution. The withdrawal slip usually has a spot to designate from where you’re taking the funds.

You’ll need to present the withdrawal slip to the teller with your account information. Personal identification is necessary for this step, and some banks or credit unions might ask to see your debit card from that institution.

Once you’ve made the cash withdrawal, the funds get deducted from your account. The teller then hands over the money stacks.

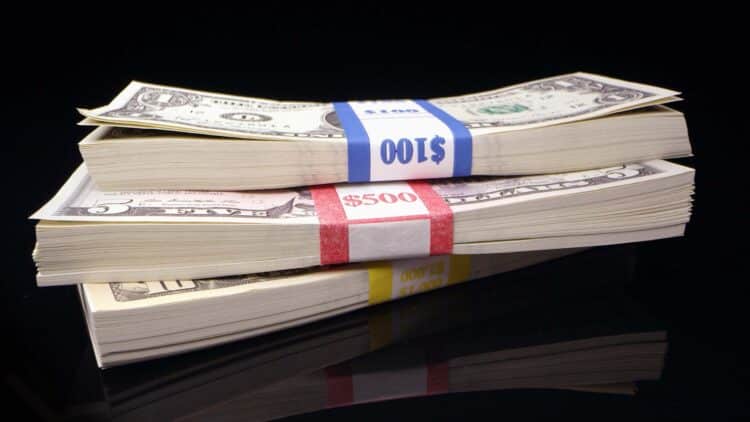

You’ll see the stacks coming with bands around the money when you withdraw a significant amount. It is always best to request each one get counted in front of you to ensure you’re receiving the entire amount of your request.

Can I Withdraw Money Stacks from ATMs?

Most ATMs have withdrawal limits that prevent you from acquiring multiple money stacks from your account. This equipment is designed to provide the fast cash access needed for an immediate transaction, so most accounts are limited to requesting $1,000 through this system per day.

Weekly, monthly, and annual ATM withdrawal limits might apply to some digital accounts and smaller banks or credit unions. You can often request to have these figures raised, but it’s usually easier to ask for money stacks in person with a teller rather than with a debit card and PIN.

If you need to request money from an ATM, the first step is to ensure your surroundings are safe. Once you know that others cannot see your transaction or are waiting for their turn at an appropriate distance, you can follow this procedure to acquire money from your account.

- Insert the debit card into the designated spot on the ATM. Some machines will lock it in place, while others want you to swipe. Follow the instructions on the screen.

- Enter your PIN when prompted. The personal identification number is typically mailed to you from the debit card issuer. You cannot proceed from this step if you don’t know this information.

- Select the account from where you’d like to take the money, then tell the ATM how much you want to withdraw.

- Most ATMs today charge a fee for accessing your cash with this method. Your financial institution does the same if the machine is outside its network. It can be $5 or more to process this transaction, so consider how much you need to make it worth requesting money.

- Once you approve the fees, the ATM will return the debit card and distribute the requested cash.

How to Increase Security and Reduce Loss with Cash Stacks

Even though we’ve transitioned to cashless transactions, approximately 40% of sales are still made with cash today. Paper currency is a convenient option that processes quickly without needing additional upcharges to pay the processing fees.

Cash doesn’t require a signature or PIN. Large denominations just need to be checked to ensure they aren’t counterfeit.

When fewer people are responsible for handling cash, your security risks become lower. That principle also applies to personal currency because fewer individuals know you’ve got money, which means you’re less likely to be targeted.

Although you could store cash at home by keeping it under a mattress or hiding it in a unique spot, the best option is to invest in a safe.

It would be best if you had a safe that bolts to your wall or floor to protect your money stacks. Without this security feature, someone could take everything during a burglary and break into it on their own time.

The best money safes must also offer a significant fire protection rating to ensure your cash doesn’t ignite inside if a fire occurs.

What Is the Best Home Safe to Use for Protecting Stacks of Cash?

The SentrySafe Fireproof and Waterproof Steel Home Safe is an excellent option for those wanting additional security for their money. It allows you to secure your documents and valuables while offering a minimum of 60 minutes of fireproof protection. It’s verified to withstand a 15-foot fall during a fire and remains closed while enduring temperatures of up to 1,700°F.

I prefer the 2.05 cubic-foot model with its interior lighting and extra space to ensure enough room for everything. It’d be nice to fill it with stacks of cash, but that’s where we place our birth certificates, mortgage agreements, and other vital documents. The USB drives with family photos are also there, as are a few collectibles.

The security of the SentrySafe home safe is incredible. It uses six one-inch locking bolts to make it nearly impossible for the average thief to penetrate. A pry-resistant hinge bar is included in the design to prevent further forced entry.

I appreciate the simplicity of the bolt-down kit that comes with the safe. Combining this feature with the other security options allows you to protect your valuables easily. It’s even waterproof for up to 24 hours in eight inches of standing water.

How to Manage Stacks of Cash Wisely

The best way to build stacks of cash is to manage the money wisely. Start by making a financial plan that limits expenses and encourages savings, then save for short-term costs and emergencies while making long-term investments. Credit can be a helpful tool, but it should be used wisely to avoid significant debt.

When I was young, my grandfather liked to play a counting game with us. He’d start with pennies, then proceed up to $10 bills.

Grandpa ran a convenience store and gas station, so he always brought a lot of cash home each night. We’d put the pennies, nickels, dimes, and quarters into different rolls so that they were easier to deposit at the bank.

He also had $100 bands that we’d place around the $1, $5, and $10 bills.

If it had been a good day, I knew he might let me keep some of the money we were counting. It was usually a roll of coins that he’d give us, but one day, I got to have one of the cash stacks.

It might have only been $100 I received that day, but it felt like I was the richest kid in the world at the time.

We’d spend an hour or two sorting Grandpa’s earnings. Then everything went into the safe until he went to the bank in the morning.

Knowing how much money is in a stack makes it much easier to manage it. Don’t forget to protect this asset by investing in a secure safe to ensure unexpected events don’t wipe you out financially.